Most Founders Who "Exit" Take Home a Fraction of What They Expected

Liquidation preferences. Board control rights. Cap table math that works against you. The structural game that determines who actually gets paid — and how much — is invisible until it's too late.

No payment required to apply

This System Has Been Taught to Founders and Executives Worldwide

What Most Founders Never See Coming

The difference between a life-changing exit and a devastating one isn't the exit price. It's the structure.

A founder raised $336M at a $1.2B+ valuation. Sold for $3.4M. Because of liquidation preferences, the founder's take-home was essentially zero.

Another raised $41.2M and exited for $270M. After preferences cleared, the founder received nothing. Investors got paid. Founder didn't.

These were normal deals that went sideways due to structure — not incompetence, not market failure.

Ask Yourself:

Do you know exactly what you gave up in your last round — and what triggers let investors take more?

If your board decided to replace you as CEO in the next 18 months, would you see the signals early?

Have you ever accepted terms under time pressure that you didn't fully understand?

If you hesitated on any of these, you're not alone — and you're not safe.

Two Operators Who've Navigated These Exact Traps

One built and sold a company for $5.75B. The other has trained founders across four continents. Together, they created the system they wish they'd had.

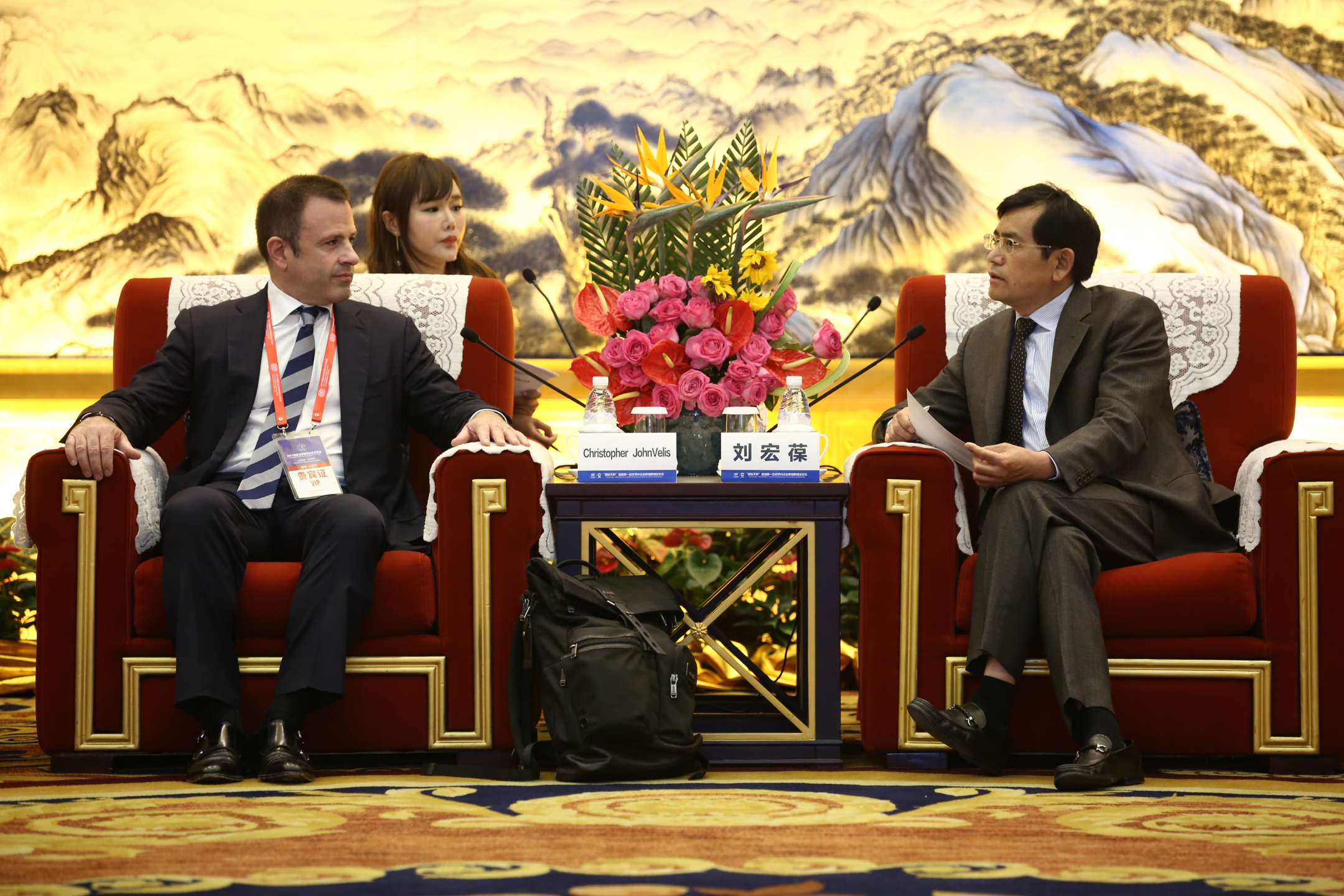

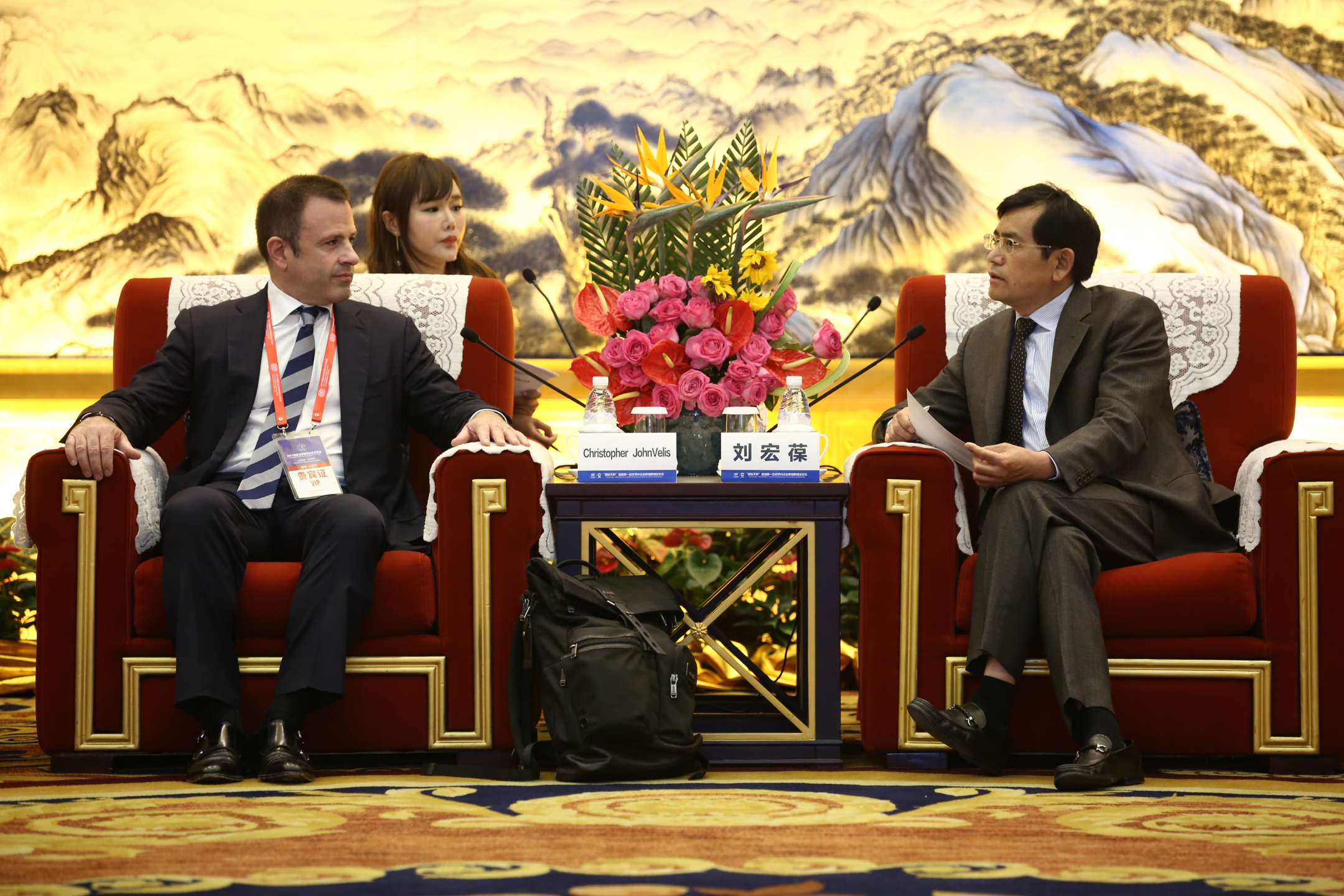

Christopher Velis

Unicorn Builder. Built and sold Auris Health to J&J for $5.75B. Decades in tech, AI, robotics. Raised $1.7B+ in institutional funding. Multiple M&A Exits. Professional Venture Investor.

Dr. Christos Kelepouris

UAE-Stanford E&I Fellow. Fulbright Specialist. Real Estate Portfolio Builder. Twenty years building ventures and curricula accross the United States, M.E.N.A., Asia, Europe.

7 Courses That Close the Structural Gap

Each course addresses a specific vulnerability in the founder risk stack. This is your defense system.

Resilient Founder Mindset

Mental toughness and adaptive decision-making under pressure.

Brand Authority & Positioning

Clarify your category and value so leverage in negotiations increases.

Raising Capital & Cap Table

Raise on fair terms, protect equity, structure deals that reduce dilution risk.

Negotiation Mastery

Frameworks from billion-dollar deals applied to term sheets and power dynamics.

Board & Governance

Turn your board from a reporting obligation into a strategic asset.

Systems for Scale

Partnerships and operating structures that let you scale without losing control.

Exit & Succession

Build a company with transferable value, clean cap tables, and real liquidity options.

AEIOU Founder Credential

Complete all 7 courses and comprehenieve exam to earn the credential — signaling to boards and investors that you understand the structural game.

Mapped to Your Actual Risk Stack

The 7 courses map directly to the 4 risk categories that determine founder outcomes.

Capital & Terms

Courses 3, 4

Board & Governance

Course 5

Strategy & PMF

Courses 1, 2, 6

Exit Architecture

Course 7

From Structurally Exposed to Structurally Literate

Before AEIOU

After AEIOU

What Happens When You Understand Structure

Results from our teaching, advisory, and mentorship work.

The negotiation framework saved us from accepting terms that would have cost millions. We rejected the first offer and closed better.

Board prep went from 10+ hours of scrambling to a 45-minute update. We closed at a higher valuation because numbers matched story.

Entered partnership negotiation with the walk-away framework. Rejected first offer and secured terms that protected future exits.

We finally had a shared language for strategy, capital, and execution. Team stopped arguing opinions and started working from one system.

Results from prior teaching and advisory. Details verified.

Who This Is NOT For

Founders who believe investors will always act in their interest.

Investors have fund timelines and fiduciary obligations that may not align with yours.

Founders who think governance is a legal formality.

Board composition and consent rights shape every major decision.

Founders who assume exit math will work itself out.

Liquidation preferences and seniority stacks determine who gets paid.

Executives at large companies, lifestyle business owners, or pre-product founders.

This is for founders with — or expecting — a board and cap table worth protecting.

AEIOU is for founders who understand the meta-game exists — and want to master it before it masters them.

How It Works

100% Virtual

Join from anywhere

4-Month Cohort

Structured progression

7 Courses

9 live sessions

3–5 Hours/Week

Designed for founders

Join the Founding Cohort

Founder Seat

Full 7-course system for one founder

Founding rate · $5,500 after

Founder + Operator

Full 7-course system for two

Includes 2 seats

Founder + Advisory

7 courses + private strategy

Program + private sessions

No payment required to apply. Tuition due only after acceptance. Most expense as executive education.

Questions? EMAIL US

The Application Takes 3 Minutes

Start Your ApplicationCommon Questions

Business schools teach disconnected theory. Incubators focus on early traction. AEIOU teaches one integrated 7-course system for structural mastery — capital, governance, negotiation, and exits — built from a $5.75B outcome.

Most participants aren't actively raising. Structural literacy applies to partnership negotiations, board management, strategic hires, and operational decisions. Best to learn before you need it.

3-5 hours per week over 4 months. Live sessions are recorded, but the cohort is built for active participation.

Yes. Most participants expense AEIOU as executive education. We provide template language for your CFO or board after acceptance.

Response within 72 hours. If there's fit, we may schedule a brief call. No obligation until you accept and submit payment.

The Structural Game Is Real.

Learn to Play It.

Founding cohort starts February 2026. 20 seats total. The founders who complete these 7 courses will operate differently for the rest of their careers.

Start Your ApplicationNo payment required · No obligation until acceptance